Exness Calculator

Calculate the amount of money you can make or require to trade with the Exness investment calculator. All that you need to do is enter the starting amount and pick your trading options and it shows you your probable earnings or the investment required. Simple and user-friendly, it is a tool every trader ought to use.

What is the Exness Investment Calculator?

The Exness calculator will come in handy and help the traders work out the probable amount that they are to pocket as profit and possible losses quickly in a trade. It helps in decision-making, with the ability to give clear figures on how the trade might turn out given inputs. Whether you’re planning your next move in forex, commodities, or any other market, this calculator simplifies the math.

The Exness Calculator simplifies the accurate calculation of your trading expenses, expected return, and risk levels with no need for complex formulas or spreadsheets. You only need to input your trade details, like the amount you’ve invested, leverage, and instrument type, into the provided calculator, and that’s it. This is very important for a trader who is keen to be on a par with the management of his investment.

Why Use the Exness Calculator for Trading?

Using the Exness Calculator for trading offers several benefits:

- Accurate Calculations: It ensures that potential profits, losses, and trading costs are all computed accurately without leaving any guesswork.

- Time-Saving: This calculates complex trading equations instantly without your precious time going to waste, which is supposed to be used in the analysis of markets or planning strategies.

- Risk Management: This does help the trader understand and manage his risks better since it does provide clear insights into the potential outcomes to the trader.

- User-Friendly: The platform is designed to easily engage traders at all levels, be it beginners or professionals.

- Versatility: It calculates through numerous trading instruments and account types, ensuring that it is equally useful for all Exness users.

- Informed Decision Making: This includes helping the trader make an informed decision by offering more details on the potential outcome of each trade.

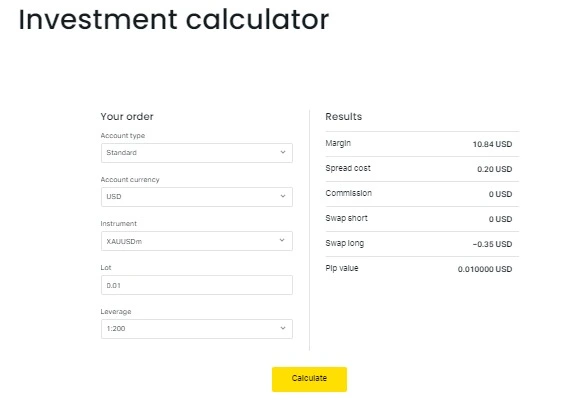

How to Use the Exness Calculator

To calculate using the Exness Calculator, you will need to input some of the trade details in mind, like the type of financial instrument being traded, volume in lots, account type, and leverage with which you would like to trade. This setup is straightforward, designed to be user-friendly for both beginners and experienced traders.

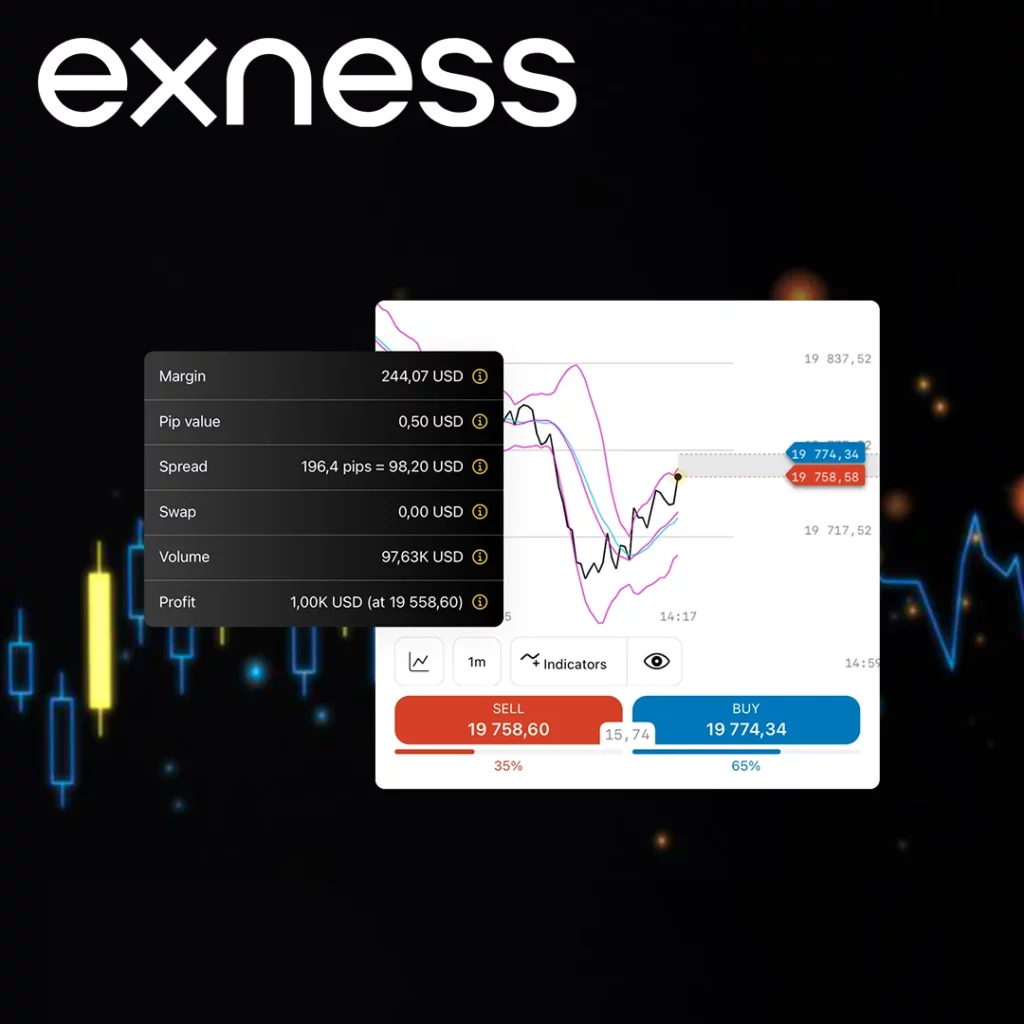

Once you’ve entered your trade information, simply click the ‘Calculate’ button. Then the calculator gives you vital details, such as the required margin for your trade, pip value, and potential profit or loss based on the prices that the current market provides.

Utilizing the Exness Investment Calculator

- Initial Setup: Input your initial investment amount or the capital you intend to use.

- Select Investment Options: Choose the type of financial instruments you plan to invest in.

- Adjust for Variables: Take into account variables like leverage, spread, and any other relevant details that affect your investment.

- Review Results: The calculator shows its estimate of the potential returns and helps to strategize the investments much better.

Understanding Margin Calculations

- Input Required Details: Start with your currency pair, account leverage, and trade size.

- Calculate Margin: The calculator will use these details to compute the required margin to hold the position open.

- Interpret Results: Understanding the margin required can help manage your account’s equity and prevent margin calls.

Calculating Profit and Loss

- Set Trade Parameters: Input details of your trade including the instrument, lot size, entry price, and exit price.

- Use the Calculator: At a click of a button, the calculator shows the potential profit or loss based on your inputs.

- Adjust Your Trading Strategy: Based on that, adjust your trading strategy, manage your risk, and plan future trades effectively.

Selecting Account Type and Instruments

Important to choose the right account type and instruments to use the best trading with an Exness Calculator. In this, each kind comes with its benefit, like different spread options in leverage and the possibility of varied commission fees. All these can affect your trading. Of course, important is matching the right account type with your style of trading; trading style and goals. Novice traders would have a Standard account, while more advanced traders who are after tight spreads and advanced features would take a Pro account.

Inputting Position Details

- Specify the type of financial instrument (e.g., forex, commodities, indices).

- Enter the volume of your trade in lots.

- Choose the leverage you wish to use.

- For forex trades, input the currency pair.

Choosing Account Currency

- Select your preferred account currency for displaying results.

- This choice ensures that profit, loss, and margin calculations are in a currency you understand and manage.

Analyzing Results

- Review calculated margin requirements to ensure sufficient funds in your account.

- Examine potential profit or loss to assess trade viability.

- Check pip value for understanding the impact of price movements on your trade.

Benefits of Using the Exness Calculator

The Exness Calculator trading by simplifying profit, loss, and trading costs calculations, saving time and reducing errors. Its user-friendly interface benefits traders of all levels, aiding in risk management, smarter decision-making, and enhanced trading strategies.

Benefits of the Exness Investment Calculator:

- Simplifies profit, loss, and trading cost calculations.

- Saves time and reduces errors in forecasting.

- Empowers traders to make smarter choices swiftly.

- Aids in effective risk management by calculating needed margins.

- Helps gauge the effects of price fluctuations on trades.

- User-friendly interface suitable for all types of traders.

- Enhances trading outcomes for both beginners and experienced traders in Forex and CFD markets.

Maximizing the Use of Leverage

Leverage in trading lets you manage a large position with just a small amount of capital. However, it also carries the risk of greater losses. To make the most of leverage, follow these strategies:

- Understand Leverage: Begin by grasping how leverage impacts your trades. It’s important to know the leverage ratio your broker offers and how this influences your trade size and margin needs.

- Use Conservatively: Although it might be tempting to use maximum leverage, it’s smarter to use it cautiously. Adjust your leverage according to your risk appetite and trading plan.

- Implement Stop-Loss Orders: Use stop-loss orders to safeguard your capital from significant losses. These orders automatically close your trades at a specific price point to limit losses.

- Monitor Margin Levels: Keep an eye on your account’s margin levels to make sure you have enough capital to maintain your positions and steer clear of margin calls, which might force you to close positions at a loss.

Strategies for Effective Risk Management

Risk management is critical for enduring trading success. Employ these strategies to manage risks effectively:

- Risk-Reward Ratio: Evaluate the risk-reward ratio before entering any trade. Opt for trades where the potential reward outweighs the risk, such as a minimum ratio of 1:3.

- Diversification: Minimize your risk by diversifying your investments across various instruments or markets. Avoid investing all your capital in a single trade or market.

- Protective Orders: In addition to stop-loss orders, consider using take-profit orders to secure your earnings automatically. Trailing stops can also be useful, as they adjust to the market, safeguarding profits while limiting losses.

- Regular Review and Adjustment: Continually review and adjust your trading strategies to align with market changes and your trading results. Be ready to reduce your exposure or tweak your strategies in response to market volatility or changes in your trading performance.

Applying these leverage and risk management strategies can significantly boost your trading efficiency, protect your capital, and enhance your chances for long-term success in the trading arena.

Integrating the Calculator into Investment Strategy

Integrating the Exness Calculator into your investment strategy can dramatically enhance decision-making and boost your trading performance.

Pre-Trade Analysis

- Trade Planning: Use the calculator for analyzing potential profits, losses, and required margins for different trade setups. This enables comparison of various strategies before execution.

- Risk Assessment: Calculate the risk for various positions to align your strategy with your risk tolerance level. Calculating potential losses for different scenarios helps in setting appropriate stop-loss levels.

Real-Time Decision Making

- Position Sizing: Adjust your position size based on the calculator’s output to effectively manage risk, maintaining an optimal risk-reward balance.

- Leverage Adjustment: Use the calculator to gauge the impact of different leverage levels on your trades. Modify leverage in accordance with the risk you’re prepared to take and the margin requirements.

Post-Trade Evaluation

- Performance Analysis: After closing a trade, review its performance with the calculator to see if the outcomes match your initial projections and identify areas for improvement.

- Strategy Refinement: Refine your trading strategy based on the outcomes of your trades and the precision of your pre-trade calculations, ensuring better alignment with market dynamics.

Continuous Learning

- Market Understanding: Regular utilization of the calculator fosters a deeper comprehension of market movements’ impact on your trades, leading to more nuanced market analysis.

- Adaptability: By weaving the calculator into your strategy and absorbing its insights, you enhance your adaptability to market changes, thereby improving your trading agility.

FAQs: Exness Calculator

What is the Exness Calculator?

The Exness Calculator is a trading tool designed to help traders calculate potential profits, losses, margins, and other important financial metrics for their trades. It supports a wide range of financial instruments and is tailored for use with Exness trading accounts.

How do I access the Exness Calculator?

The Exness Calculator can be accessed directly from the Exness website or trading platform. Navigate to the tools or resources section to find and use the calculator.

Can I use the Exness Calculator for all types of trading accounts?

Yes, the Exness Calculator is designed to support all types of trading accounts offered by Exness, including Standard, Pro, and others, allowing for a wide range of calculations tailored to each account type.

Is the Exness Calculator free to use?

Yes, the Exness Calculator is a free tool provided by Exness to its clients to aid in their trading decisions and strategy planning.

How does the Exness Calculator improve my trading?

By providing accurate and instant calculations of potential trade outcomes, the Exness Calculator helps traders assess risk, manage their investments more effectively, and make informed decisions that align with their trading strategy and goals.

Can the Exness Calculator calculate the risk for my trades?

Yes, the Exness Calculator can help estimate the risk for your trades by calculating potential losses and required margins, allowing you to adjust your trading strategy accordingly.

Does the Exness Calculator take into account leverage and spread?

Yes, the Exness Calculator allows you to input leverage and spread values for your trades, ensuring that the calculations are as accurate and relevant to your trading conditions as possible.

Can I use the Exness Calculator for currencies not in my account?

Yes, the Exness Calculator supports calculations in different currencies, allowing you to see potential outcomes in currencies other than your account’s base currency.